Blog

-

Life Insurance 2.0 & the Death of the Health Exam

April 7 2017

-

Insurance Accelerators: Fueling Innovation

April 6 2017

-

Peer-to-Peer Insurance: Mutual by Another Name or Transformative Innovation?

April 11 2017

-

Insurance Industry Innovators: An Asian Perspective

April 10 2017

-

Insurance Applications of Blockchain

-

Insurance Industry Should Get Ready to Embrace Loyalty Marketing

-

Ideas 42 Applies Behavioral Economics to Insurance

April 5 2017

-

Global Insurtech Trends to Watch for in 2017

April 4 2017

-

Implementing Analytics for Tangible Results, as Explained by Dax Craig of Valen Analytics

April 3 2017

-

Machine Learning and Artificial Intelligence: Applications for Insurance

March 31 2017

-

Maddock Douglas, Why We Are At InsureTech

November 3 2016Maria Ferrante-Schepis, gives a ridiculously short explanation about Maddock Douglas, Inc, innovation consultancy in Elmhurst Illinois, exhibiting at InsureTech Connect, Las Vegas.

-

GetmeIns Interview on Insuretech Connect 2016 Las Vegas

November 2 2016An interview with Eugene Greenberg (getmeIns, CEO) and Dmitry Geyzersky (getmeIns, CTO) at Insuretech Connect 2016 in Las Vegas. They speak about innovative platform for Insurance Fraud Prediction they are developing. Furthermore, Eugene and Dmitry explain their unique approach to combating fraud as a terrorist activity using intelligence techniques.

-

ClientDesk - Digitizing Insurance and Mobilizing Policyholders

October 31 2016ClientDesk is a software platform built for insurance carriers, brokerages, and agencies that powers core functions of the digital insurance experience such as Engagement, Self Service and Claims Management. The company provides white-labeled policyholder web portals and mobile apps, as well as a management dashboard used internally by brokers and insurance agents.

In this interview, we meet Randy Carroll, the Chief Business Officer of ClientDesk. He tells us a bit about the startup, and speaks on his time at InsureTech Connect 2016.

-

Insurance Thought Leadership Promotes InsurTech

October 29 2016Insurance Thought Leadership is a global network of thought leaders and decision makers transforming the insurance and risk management marketplace through insights on innovation and technology. Our mission is to provide a powerful platform for the smartest thought leaders with the best ideas. We help our network to be smarter about the drivers transforming the industry and we connect members in ways that lead to innovation and enable that transformation.

-

Interview with GAPro's Cofounder, Chet Gladowski.

October 28 2016GAPro is a Verification-as-a-Service (VaaS) global compliance solution for all kinds of insurance. GAPro collectively delivers shared information and efficiency while digitally connecting and reducing overall cost to all four insurance stakeholders (carriers, agent/brokers, insured and 3rd parties).

-

PowerWallet Plus Showcases Innovative FinTech & InsurTech Integration at InsureTech Connect Conference

October 28 2016After years of investment, FinTech is now reaching maturity and achieving a mainstream position in the marketplace. InsurTech Investment is on the rise, and insurers must ask themselves to what extent they want to be involved in the FinTech revolution. One way to do this is to utilize the PowerWallet Plus personal financial management platform - now available to be white-labelled and branded specifically for your business!

-

Jornaya - The Power of Intent

October 26 2016Take a front-row seat on your consumer's buying journey, and shorten the distance between data and decision-making with Jornaya.

-

The Gig is Up in the Insurance Industry

October 24 2016WeGoLook is disrupting the way insurance carriers traditionally operate in the field to conduct inspections, verifications, and tasks. At InsureTech Connect, WeGoLook's Robin Smith spoke on a panel about how their mobile technology platform increases workflow efficiency to expand insurance operations. For example, if a carrier is needing to augment or supplement their labor force, WeGoLook is able to dispatch one of 30,000 + Lookers (agents) very quickly and cost effectively to capture data for underwriting and claims purposes.

The gig economy's disruption in the insurance industry and the existence of "crowdworkers" creates four main opportunities for insurers: a faster flow of information, claim process efficiencies, information customization, and cost efficiencies.

-

Opportunities in Insurance Tech

June 22 2016

New Innovations Mean Big Opportunities in Insurance Technology

Investor enthusiasm for technological innovation often seems to emerge from nowhere and gain incredible momentum until a crash happens because interest goes elsewhere. Today, many observers believe that insurance technology is on that path. Fintech has seen huge investor interest recently, and many entrepreneurs are coming around to the opportunities in this consumer service industry.

-

Business Insurance Innovators

June 13 2016

The rapid rise of Zenefits has spurned an incredible amount of buzz around the idea of commercial insurance brokerage. The company sells into human resources and centers its focus on facilitating benefits and personal coverage lines such as health and disability policies. Products such as cyber-security insurance, director and officer policies and general liability insurance offer another exciting opportunity within the commercial market. These products are geared toward corporate risk; they target buyers like chief compliance, technology or operating officers.

-

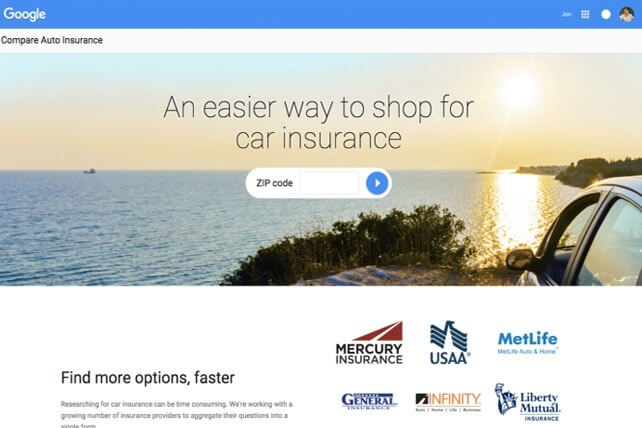

Google Shuts Down Its Insurance Comparison Product

June 1 2016

Google recently confirmed that it would eliminate its financial and insurance comparison tools. These tools have been available to people seeking credit card, insurance, and mortgage services since last year. Despite the relative success and helpfulness of these tools, Google has still decided to withdraw them and instead offer answers for such services through Adwords.

-

How Much Money Insurance Agents Make

May 23 2016

Insurance sales are all about the exchange of information. To put together an effective policy, insurance companies require consumer data. This is also true for other industries that require such data, including real estate, vehicle sales and transportation. In a variety of those markets, the Internet is the primary facilitator, yet in-person agents are still used. According to data from A.M. Best IIAMA Market Share Reports, in-person agents are the primary distribution channel for commercial, life, homeowner and automobile insurance. It's important for insurance agents to be able to validate and reassure their customers in person, so they have limited online access to transactions to some degree.

-

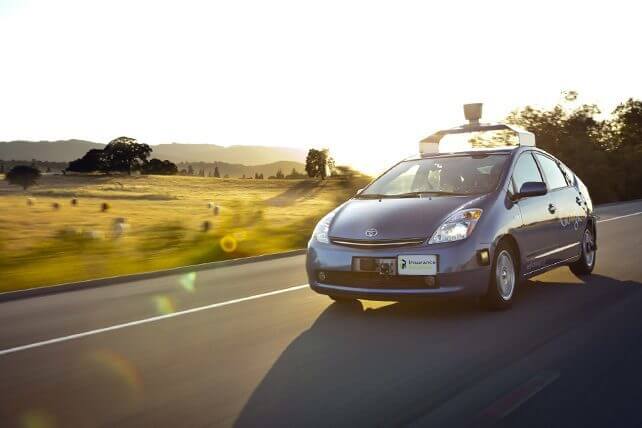

How Will Self Driving Cars Effect Auto Insurance

May 7 2016

Several times in science fiction movies over the last 50 years, we've seen self-driving cars. In the world of 2016, such cars are rapidly becoming part of the real world rather than the imaginary world of film. Every year, production cars come off the assembly line with more self-aware features than in the previous year. As few as 10 years ago, crash avoidance, automatic parking, front-end collision warnings that automatically apply the brakes for you and quite a few other innovations were only dreams on a whiteboard. Now, at least one car manufacturer has boasted that self-driving cars will be the vehicle of choice by the end of the decade.

-

Insurance Industry Disrupters

April 20 2016

Most policyholders do not understand the complex terms and fees of their insurance policies, which is why they make unfavorable purchases. There is also a lack of communication between insurers and their policyholders, which worsens existing issues.

It may take several weeks to underwrite a policy. With the paper-based structure, claims are difficult and lengthy. However, this is not an impossible obstacle for trusted insurers who have the right licenses and valuable analytical benefits.

-

Insurance Technology Industry Conference

April 12 2016

News about a conference for the insurance technology industry, OnRamp, deserves passing along to interested stakeholders. An increase in innovative activity among online brokers and aggregators makes it particularly relevant now.

Online insurance marketing lets startups eliminate unnecessary stress and confusion that often accompany shopping for insurance policies. By bringing the experience into a digital environment, startups empower consumers to shop for affordable options that conform to their preferences. Decision-making tools enable shoppers to get realistic feedback about insurance needs and avoid unnecessary expense.

-

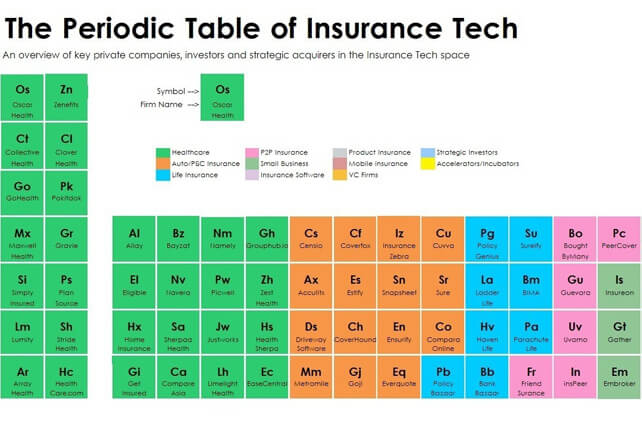

Insurance Tech Startups Landscape

April 5 2016

With an onslaught of new tech startups, here are the top 125 players you need to be aware of in the insurance technology landscape. Venture capitalists, corporate investors and other private insurance companies are all supporting the newest life, health, property and casualty insurance applications.

Here is the industry table called the Periodic Table of Insurance Tech. This valuable visual tool clearly outlines the key players in the quickly-growing insurance tech landscape.

-

Investments Into Insurance Tech Startups Are Growing

March 28 2016

The insurance industry is quickly discovering the potential impact of technological innovations. The first segment to be transformed by technology investments was health insurance, but life insurance and commercial liability insurance are now following suit. In 2015, the excitement surrounding insurance technology led to more than $2.6 billion in global investments, and six trends for 2016 have already been identified.

-

More Insurers Are Partnering With IoT Companies To Offer Fantastic Consumer Discounts

March 17 2016

Major insurance companies are working with the "Internet of things" companies to maximize their ability to provide real-time monitoring service and more. Insurance companies such as State Farm, AXA and Liberty Mutual are offering real-time monitoring of vehicles, homes and other insurance risks. One of the main ways for insurers to take advantage of these opportunities is to work with startups as they emerge. However, many are choosing to work with existing tech giants.

-

Peer to Peer Insurance Innovation

March 2 2016

Insurance may seem like a modern invention, but the idea of using group assets to protect individual losses is hardly new. In the middle ages, tradesmen used a guild system, collecting fees which could be used to help members as needed. By the 1600s, coffeehouses in London began underwriting, which ensured that all owners were equally protected in case of the worst.

Over the centuries, the fundamental principles of insurance have remained. The latest evolution of this idea is upon us now with the invention of peer-to-peer insurance firms. These P2P firms strive to close the distance between the insurer and the insured.

-

Practical Matters of Insurance Tech Start up

February 26 2016

There are many informative articles that discuss the patterns in the insurance industry for those just starting out to focus on to maximize the opportunities available. However, there are practical matters to be considered relating to operations of a new company.

Insurance carriers are no longer looking for new agents to sell their products, especially ones that are not already established. Before you arrange appointments with carriers, consider the following:

-

What will Insurance Tech Change

February 2 2016

Insurance Revenue explains why microinsurance is transforming the insurance industry and making insurance more accessible to everyone.

Traditional insurance typically comes as one-size-fits-all policies. Subscribers pay for a policy that encompasses a broad range of circumstances, regardless of whether or not the policy holders will ever have need for it. While people typically are covered for the basics of what they need, they also may not want to pay for extras that they may never use. To accommodate people interested in tailored insurance policies, more insurers are offering microinsurance.

-

Why Google Shuts Down Its Insurance Comparison Website

January 20 2016

When Google announced it was shutting down its insurance rate comparison site, Google Compare, this naturally generated a fair amount of buzz in the insurance industry. After all, Google is such a successful company, any apparent misstep by Google is bound to generate a lot of commentary.

Insurance Journal was the first industry publication to report on Google's announcement regarding its plan to shutter Google Compare. The site began ramping down operations in February 2016 and ended operations the following March.

-

Why Multi Product Insurance Shopping Portal is a Good Idea

January 17 2016

Online search platforms like Indeed, Zillow and Airbnb tend to reward insurance products that are confined to a single category. The typical customer has already invested some form of interest in pursuing this category. Brands who can accommodate the consumer's existing interests are most likely to succeed. Many consumers harbor the belief that purchasing decisions are made from logical reason and informed research; however, we know that most people still base major decisions on issues that reinforce their pre-existing, emotional ideas about their own identity.